Rules of Origin, Explained

Jul 14, 2017

Scroll to find out more

Jul 14, 2017

Scroll to find out more

Rules of Origin (RoO) are used to establish the level of ‘local content’ in products. This determines whether those goods are deemed to ‘originate’ in a certain country and therefore whether they qualify for preferential treatment under the relevant trade agreement.

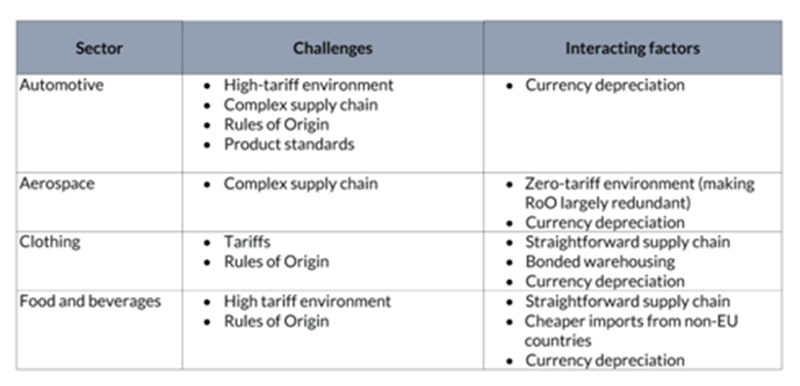

Even if the UK were to have a FTA with the EU post Brexit with zero tariffs across the board, the following goods being exported from the UK to the EU would need to be treated differently:

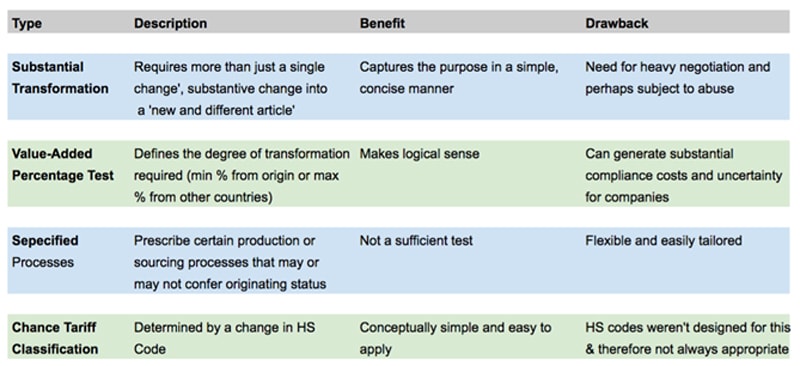

There are several methods for determining RoO (see image below). However, what is clear is that RoO are very expensive and sometimes lead to companies willingly paying WTO tariffs, even when there is an FTA in place, to avoid the administrative cost and uncertainty. According to the 2016 Reuters and KPMG Global Trade Management Survey, 77% of companies don’t take full advantage of FTA’s, with the biggest reason being complexities of Rules of Origin (23%).

At Zencargo, we are optimistic that technology can play a big role in reducing the administrative headache of Rules of Origin, with Blockchain being of particular interest.

Technology has a huge role to play in the upcoming Brexit negotiations – especia...

CHIEF:Customs processing in the UK is presently handled by a system called C...