Zencargo Market Update: 9th May

May 09, 2023

Scroll to find out more

May 09, 2023

Scroll to find out more

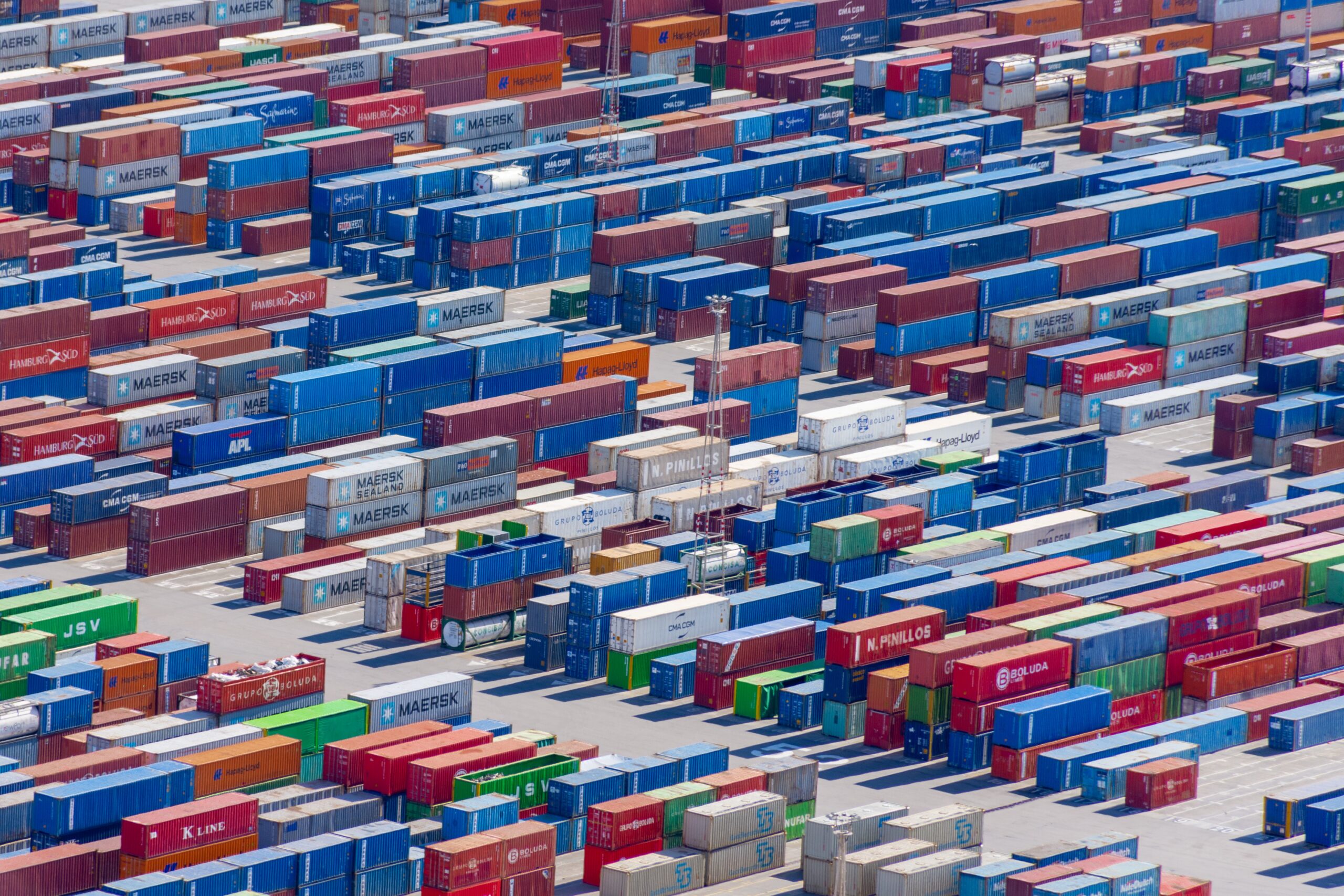

After 6 months of demand downturn, it appears that demand, once again, is on the rise… but not everywhere. Through analysis of global TEU miles, Sea-Intelligence has determined that demand on a global level has increased in March, an indication that we may have passed the bottom of the market with figures “ significantly above the lower plateau seen since September 2022.”

However as stated earlier… not everywhere has seen a rebound. From the data collected by Sea Intelligence, North America is still showing decline in March. Compared with September 2022 imports are roughly 20% lower when measured in TEU miles. Proving to be an important exception to the recovery seen across Africa, South America and Europe.

However, potentially some green shoots on the horizon as FreightWaves has reported a rise in US import figures for April, jumping 9% from March. While the US represents only a single market in North America, this could be an indication that the region may join the rest of the globe in recovery in the near future.

Ocean

Air

Central China to USA and Europe

North China to USA and Europe

South China to USA and Europe

Ocean

Ocean

Ocean

Road/Rail

European Bank Holidays

We anticipate a shortage of availability and the occurrence of delays around the bank holiday periods. Plan ahead and allow extra time for your products to be delivered.

May 9 – Belarus, Bosnia and Herzegovina (FBiH)*, Guernsey and Alderney, Jersey, Kosovo, Luxembourg, Moldova, Russia, Transdniestria (PMR)

May 15 – Spain*

May 17 – Spain*

May 18 – Austria, Belgium, Denmark, Finland, France, Germany, Luxembourg, Netherlands, Sweden

May 19 – Belgium*, Denmark*

May 24 – Bulgaria

May 27 – Sweden*

May 28 – Denmark, Estonia, Finland, Germany*, Netherlands, Poland, Slovenia, Sweden

May 29 – Austria, Belgium, Denmark, France, Germany, Hungary, Luxembourg, Netherlands

May 30 – Croatia, Spain*

May 31 – Spain*

June 1 – Romania

June 2 – Italy, Romania*

June 4 – Greece, Lithuania, Romania

June 5 – Cyprus, Denmark*, Greece, Ireland (Eire), Romania

June 6 – Sweden

June 7 – Malta

June 8 – Austria, Croatia, Germany*, Poland, Portugal, Spain*

June 9 – Spain*

*Not in all regions

The information that is available in the Weekly Market Update comes from a variety of online sources, partners and our own teams. Click below to learn more about how Zencargo can help make your supply chain your competitive advantage.

In Focus: Tensions in the Middle East continue Over the past week, tensions hav...

In Focus: A market outlook Rolf Habben Jansen, CEO of Hapag Lloyd, anticipates...

In Focus: Carriers announce GRIs in April Following the Chinese New Year holida...