Zencargo Market Update: 9th February 2026

Scroll to find out more

Scroll to find out more

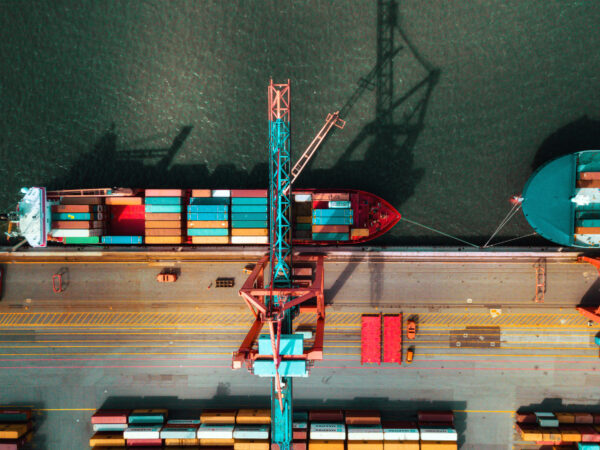

Severe winter weather systems, including Storm Leo, have impacted the North Atlantic and Western Mediterranean, driving European port congestion to its highest level since the pandemic. As storms force vessel diversions and terminal closures, total capacity currently tied up at anchorages has briefly exceeded 10% of the global fleet, removing significant supply from active rotation just as the market approaches the pre-Chinese New Year period.

The disruption has continued to move northward, with major Northern European hubs including Antwerp, Hamburg, and Rotterdam, remaining under congestion pressure. Terminal productivity has been impacted by snow and ice, causing landside delays for haulage and compounding density issues at container yards.

While weather conditions in the Bay of Biscay are forecast to improve slightly from 9th February, the operational hangover will persist; carriers warn that recovery will be gradual. As delayed vessels resume their voyages simultaneously, they are expected to arrive at destination ports in concentrated patterns. This bunching effect will likely trigger a secondary wave of congestion at terminal berths, extending transit times and straining schedule reliability into late February.

Central China (SHA/NGB)

North China (DLC/TSN/TAO/PEK)

South China (CAN/SZX/XMN)

Central China (SHA/NGB)

North China (DLC/TSN/TAO/PEK)

South China (CAN/SZX/XMN)

Antwerp

Rotterdam

Europe Public Holidays

We anticipate a shortage of availability and the occurrence of delays around the bank holiday periods. Plan ahead and allow extra time for your products to be delivered.

09.02.2026 (Monday)

10.02.2026 (Tuesday)

11.02.2026 (Wednesday)

12.02.2026 (Thursday)

13.02.2026 (Friday)

LI | Liechtenstein — 00:00–05:00; 22:00–24:00

The information that is available in the Zencargo Market Update comes from a variety of online sources, partners and our own teams. Click below to learn more about how Zencargo can help make your supply chain your competitive advantage.

Less-than-Container Load (LCL) shipping is the practice of combining cargo from...

In Focus: Red Sea retreat and tariff turbulence After leading the way in return...

In Focus: The capacity challenge for carriers For the past two years, the detou...