Russian invasion of Ukraine: freight updates and FAQs

Mar 21, 2022

Scroll to find out more

Mar 21, 2022

Scroll to find out more

Last updated: Monday, 16:40pm GMT

On Thursday 24th February, Russia invaded Ukraine. Since then, the situation has escalated with military attacks incurring a horrifying human cost.

Our thoughts are with the people of Ukraine, and we sincerely hope that this war can be brought to an end as quickly and safely as possible.

Such concerning events have an impact on the movement of goods worldwide. Here, we aim to summarise the current situation, and what it means for our customers and global partners.

Suspension of bookings to Russian and Ukrainian ports.

Some carriers are beginning to stop calling at Russian and Ukrainian ports.

Sanction controls.

Countries such as the Netherlands, Belgium and Germany are holding back vessels en route to Russia in search of restricted commodities prohibited by sanctions against Russia.

Container terminals are blocking cargo.

ECT in Rotterdam has announced that containers travelling to Russia will be blocked by customs and cannot be loaded.

Russian ships denied access to ports.

In the UK, Grant Shapps, the Transport Secretary, has written to all UK ports asking them to deny access to any Russian-flagged and operated ships.

Port congestion.

Stacking areas at hubs in Europe are already very full and we expect the impact of the Ukraine situation to present additional challenges on top of existing global supply chain disruptions.

As carriers begin to suspend shipments to and from Russia and Ukraine, ships will divert to European ports, making congestion highly likely.

Shippers are cancelling Far East Asia-Europe rail freight bookings amid speculation that sanctions could prevent cargo transiting Russia. This may result in a further uptick of demand for ocean bookings.

Fuel cost effect.

BAF (bunker adjustment factor) will fluctuate with oil prices, so rates will shift accordingly depending on review dates. MSC is first carrier to announce that Fuel surcharges will be reviewed fortnightly and not monthly for all spot and quarterly volumes – effective April 15th

Dwell times in Europe

Dwell times are increasing across Europe. This varies from 25% to 55% depending on the type of goods. Transhipment complications and heavily congested ports are also increasing transit times.

Fuel cost effect.

Changes in the price of fuel directly affects the cost of air freight. Rerouting flights to avoid Russian airspace will also result in higher fuel usage, also driving up the cost of operations.

Some airlines are therefore implementing fuel surcharges (FSC), adding to the overall cost of a booking.

Russian airline sanctions.

Russian airlines are not allowed to call at European airports. Volga-Dnepr Group’s AirBridgeCargo is the main cargo carrier affected by this, controlling lots of capacity from Asia into Europe and the US.

Other airlines affected include Aeroflot (SU), Siberia Airlines (S7), and E-Cargo (RF), SkyGates (U3).

Europe carriers potentially cancelling or rerouting Asia flights.

Europe carriers will not fly to Russia, and many are banned from Russian airspace, which is the main route for flights to and from Asia.

It remains unclear whether carriers will choose to reroute or cancel their flights. Rerouting will require more fuel; for passenger flights, this is likely to result in airlines prioritising passengers over cargo.

Finnair have already made several changes to their schedules , and other airlines are following. Lufthansa and Air France-KLM have already cancelled lots of Asia flights. Finnair announced yesterday that as of March 9, they will resume their flights to Narita, Japan, avoiding Russian airspace resulting in an additional 3 hours of flight time.

Virgin Atlantic have cancelled cargo services to Hong Kong & Beijing.

Additional potential risks.

Based on a previous update where airlines were expected to install war risk surcharges, resulting in an extra charge per kilogram on top of the usual per kilogram rate, Cargolux cargo airlines announced a war risk of 0.2$/kg for cargo to & from Asia.

The reaction from Asian and Middle Eastern carriers will also be critical with regards to flying over Russian airspace. Lots of cargo is on carriers like China Eastern, China Southern, Korean Air and China Cargo Airlines. So far, there has been no effect, but any changes will represent a further risk to the passage of goods between Asia and Europe via air.

Middle East based carriers already see a surge of bookings out of Europe, and confirmations are already up to 2 weeks for departure.

Continued change in airspace and flight bans.

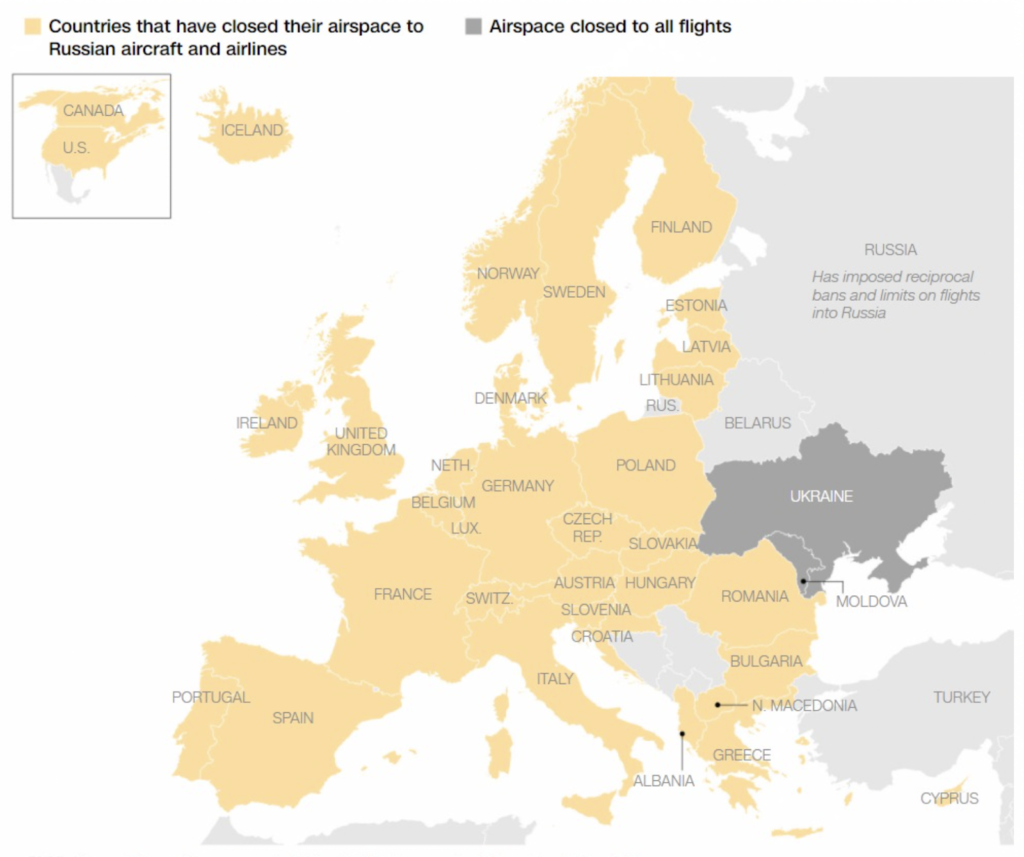

On Tuesday 1st March, the US government announced a ban on Russian flights as well, following Europe and Canada bans.

Below is a graphic showing countries that shut their airspace to Russian airlines.

As a result of all the above factors, the market started seeing rate increases of up to 50% or more on the per kg rate of February.

China-Europe rail running for now.

The bulk of traffic for China-Europe rail freight into Europe passes through Russia and Belarus, with Ukraine as a secondary gateway into Europe.

While Russian Railways has been hit by sanctions, these do not seem to have impacted the actual operation of the rail services, and China-Europe overland freight continues to move.

Effects on drivers in Europe.

Many hauliers operating European road freight services employ HGV drivers of Ukrainian nationality. The impact this is having on the drivers is unknown currently and will depend on a driver’s personal circumstances. Support is being offered to drivers wherever is needed in terms of parking for units should they wish to return to Ukraine.

Borders closed

The border between Ukraine and Russia and Ukraine and Belarus are closed. Road transportation in the region will further be impacted by more stringent border controls and heavy traffic coming out of Ukraine.

Following the invasion of Ukraine, the price of crude oil soared to its highest level since 2014, to more than $105 a barrel.

The cost of Crude Oil now sits at $120.99 per barrel. The average cost of fuel per litre rose by 22.22 pence compared to the previous week which represents an increase of 17.02%.

Russian exclusion from SWIFT banking system due to come into force.

While Russia remains in the SWIFT international payment system, transactions between international and Russian companies can still easily take place.

The Council of the European Union has now voted to exclude some Russian banks from the SWIFT system. While some major banks are not on the list of those excluded, this will still have an impact on Russia’s ability to do business internationally.

Risk of cyberattacks on supply chains.

There has been increasing concern over the likelihood of more cyber attacks from Russia. Logistics company, Expeditors, has recently been subject to a cyber attack, as well as the Port of Nhava Sheva in India, although the origins of each attack are unknown.

Five years ago, Russian hackers launched the NotPetya attack to disrupt Ukrainian infrastructure. The malware eventually reached businesses outside of Ukraine, affecting US and European supply chains. A similar attack now could cause major disruptions to shipping lines, trucking fleets and last-mile delivery companies.

Additional fuel costs.

As both the cost of fuel increases and transport providers need to reroute, incurring longer journeys, it is very likely that fuel surcharges will be applied.

Limited supply driving up prices.

The reduction in supply across all modes of transport will likely result in price spikes, especially across air freight as airlines weigh up whether to reroute or cancel flights.

For shipment-by-shipment reviews, you can either log into the Zencargo platform for the latest movements within your supply chain, or else reach out directly to your customer success manager.

To find out how you can take control of your supply chain costs and stay ahead...

To find out how you can navigate a path through uncertainty, book your free str...

To find out more about how Zencargo’s digital freight forwarding experts and te...