Transport Update 9th June 2021

Jun 09, 2021

Scroll to find out more

Jun 09, 2021

Scroll to find out more

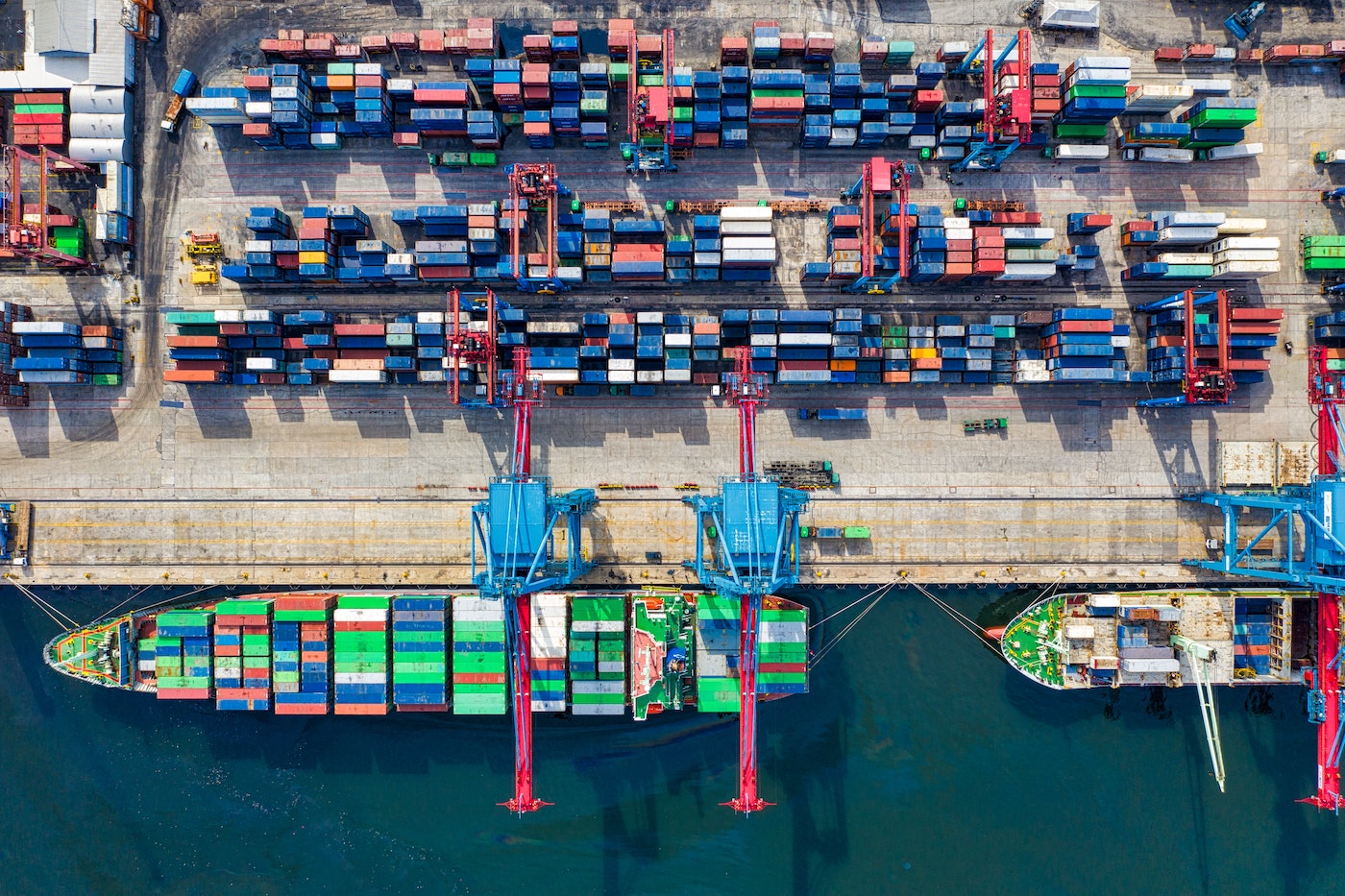

While the blockage of the Suez Canal by the Ever Given in March was headline news all over the world, the current disruption in Yantian and surrounding ports is now on track to affect a larger volumes of containers, potentially for a longer time.

Today we look at the current situation in more depth, with specific numbers and shipments covered in the usual market update.

Disruption continues to spread through the ports of Yantian, Shekou and Nansha in the Greater China Area. The main reason for this is an increase in positive COVID-19 cases, which have been escalating in the last two weeks. Local authorities are responding with restricted operations and reduced staffing levels which has significantly lowered productivity at the ports.

We are working closely with our customers and partners on sourcing alternative strategies around different shipping lines, different service levels and different port of departures. If you are a Zencargo customer, or simply in need of impartial, free advice, our supply chain teams are standing by to advise you on next steps.

Airfreight rates cooled as the month of May progressed but this is unlikely to signify the start of a return to pre-Covid levels.

Writing in the Baltic Exchange market round up, Bruce Chan, vice president of global logistics at investment bank Stifel, said this downward trend as the month progressed was unlikely to signify a return to pre-Covid levels. He said that belly capacity on international flights remained depressed due to the slow roll out of vaccination programmes and the emergence of new variants. Meanwhile, demand continues to be brisk even heading into the summer lull as consumption remains high, inventories are low and there is ongoing supply chain disruption.

For more than a decade, 100% of shipments departing from the USA on a passenger aircraft were to be screened by either a Certified Cargo Screening Facility (CCSF) or by the airline itself. Shipments departing on an All-Cargo/Freighter aircraft were excluded, but not anymore, as of July 1st 2021, all shipments must be screened. That includes cargo on carriers such as DHL, Fedex, CargoLux, UPS and any other freighter airline.

Cargo moving on a passenger aircraft is limited by size to what can fit below the passenger deck of an aircraft, and thereby making the task rather manageable. You cannot fit a large piece through an x-ray machine nor hand search a large engine. It will certainly take some time getting used to the new regulations by the industry at large. Many airline terminals and General Handling Agents are very busy as it is. Adding the screening task is certain to create delays until everybody in the supply chain is familiarised with the new regulations.

Availability generally reliable, though some issues remain with capacity from Italy. Reefer trucks are becoming more in demand as temperatures rise.

Rates remain stable across consolidated, groupage and dedicated trailers.

Border situations have improved considerably, with most crossings clearing on the same day as border staff and shippers improve compliance with post-Brexit regulations.

The information that is available in the Weekly Market Update comes from a variety of online sources, partners and our own teams. Click below to learn more about how Zencargo can help make your supply chain your competitive advantage.

In Focus: Tensions in the Middle East continue Over the past week, tensions hav...

In Focus: A market outlook Rolf Habben Jansen, CEO of Hapag Lloyd, anticipates...

In Focus: Carriers announce GRIs in April Following the Chinese New Year holida...