Zencargo Market Update: 13th February

Feb 13, 2023

Scroll to find out more

Feb 13, 2023

Scroll to find out more

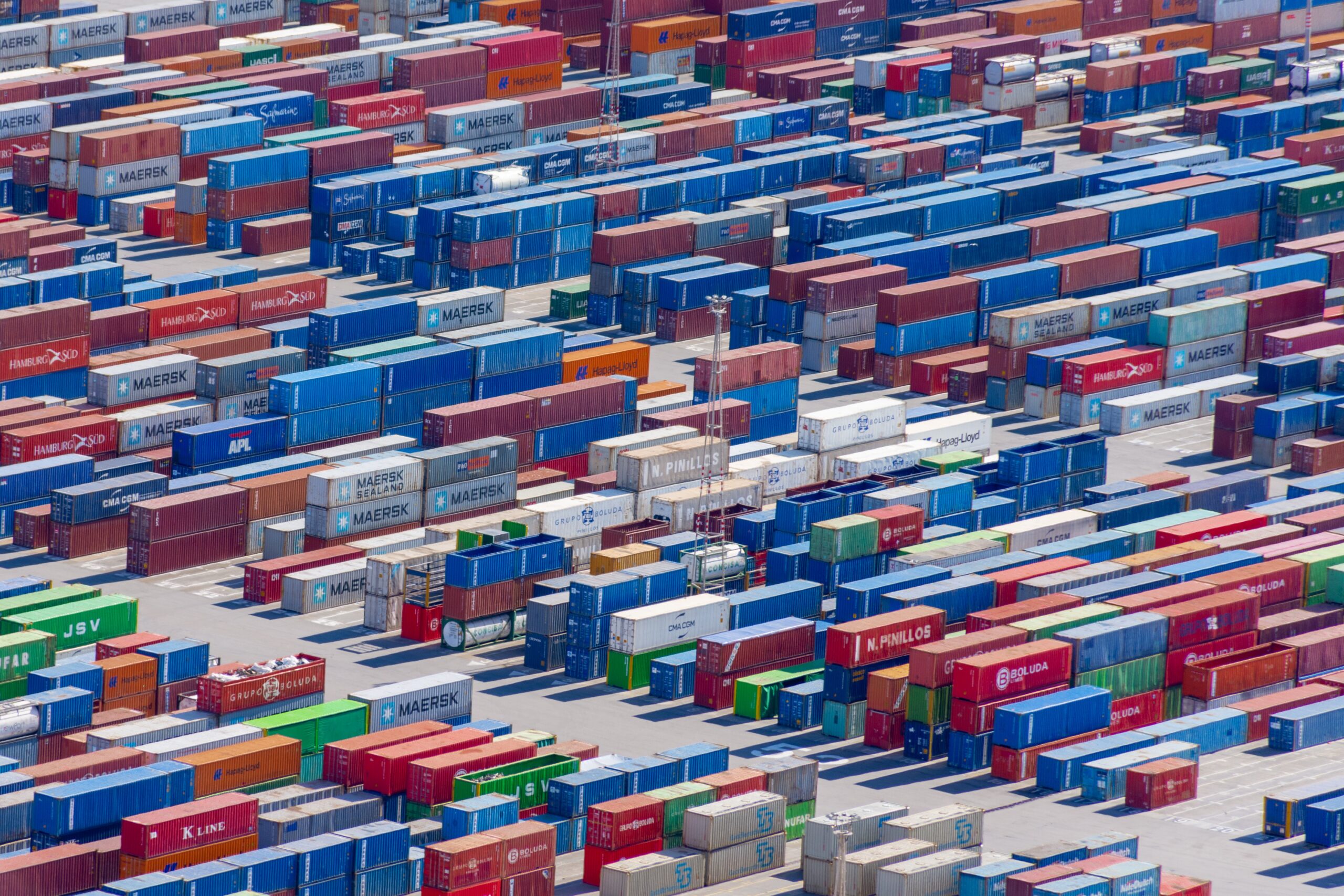

With the recent break up of the 2M alliance, Maersk has announced that being a member of a vessel-sharing alliance (VSA) was not compatible with its global integrator plans.

CEO, Vincent Clerc, shared that Maersk aims to have its ocean business fully integrated into their logistics business. And to do that, Maersk needs a much higher level of operational control over the service it delivers to customers.

Meanwhile, the shipping line has also announced that ‘muted’ economic growth is set to push the world’s container shipping volumes down by as much as 2.5% this year.

Due to a significant inventory adjustment from demand slow down, Maersk has said, “With economic activity slowing and supply chain bottlenecks easing during 2022, businesses started to accumulate inventory, resulting in a drag on trade activity”. Ocean volumes have fallen by 14% in the final three months of 2022 compared to the same period in 2021, with the decline seen across most ocean routes.

Ocean

| Carriers | POL | 20GP | 40GP | 40HQ |

|---|---|---|---|---|

| HPL | NINGBO | Normal | Normal | Normal |

| SHANGHAI | Normal | Normal | Normal | |

| YANTIAN | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| QINGDAO | Normal | Normal | Normal | |

| XIAMEN | Normal | Normal | Normal | |

| DACHANBAY | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| MSK | QINGDAO | Normal | Normal | Normal |

| DALIAN | Normal | Normal | Normal | |

| TIANJIN | Normal | Normal | Normal | |

| SHANGHAI | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| Nanjing | Normal | Normal | Normal | |

| Xiamen | Normal | Normal | Normal | |

| YANTIAN | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| NANSHA | Normal | Normal | Normal | |

| HONGKONG | Normal | Normal | Normal | |

| SHANTOU | Normal | Normal | Normal | |

| ONE | YANTIAN | Normal | Normal | Normal |

| SHEKOU | Normal | Normal | Normal | |

| XINGANG | Normal | Normal | Normal | |

| QINGDAO | Normal | Normal | Normal | |

| SHANGHAI | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| ZIM | XIANGANG | Normal | Normal | Normal |

| NINGBO | Normal | Normal | Normal | |

| SHANGHAI | Normal | Normal | Normal | |

| YANTIAN | Normal | Normal | Normal | |

| DACHANBAY | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| HMM | SHANGHAI | Normal | Normal | Normal |

| NINGBO | Normal | Normal | Normal | |

| NANSHA | Normal | Normal | Normal | |

| YANTIAN | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| MSC | SHANGHAI | Normal | Normal | Normal |

| NINGBO | Normal | Normal | Normal | |

| YANTIAN | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| EMC | YANTIAN | Normal | Shortage | Normal |

| XIAMEN | Normal | Shortage | Normal | |

| SHEKOU | Normal | Shortage | Normal | |

| NINGBO | Normal | Shortage | Normal | |

| SHANGHAI | Normal | Shortage | Normal | |

| QINGDAO | Normal | Shortage | Normal | |

| OOCL | YANTIAN | Normal | Normal | Normal |

| NANSHA | Normal | Normal | Normal | |

| SHANGHAI | Normal | Normal | Normal | |

| HONGKONG | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| CMA | QINGDAO | Normal | Normal | Normal |

| SHANGHAI | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| XINGANG | Normal | Normal | Normal | |

| YANTIAN | Normal | Normal | Normal | |

| XIAMEN | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal | |

| cosco | YANTIAN | Normal | Normal | Normal |

| SHEKOU | Normal | Normal | Normal | |

| SHANGHAI | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| QINGDAO | Normal | Normal | Normal | |

| DALIAN | Normal | Normal | Normal | |

| XINGANG | Normal | Normal | Normal | |

| YML | YANTIAN | Normal | Normal | Normal |

| NANSHA | Normal | Normal | Normal | |

| SHANGHAI | Normal | Normal | Normal | |

| QINGDAO | Normal | Normal | Normal | |

| HONGKONG | Normal | Normal | Normal | |

| NINGBO | Normal | Normal | Normal | |

| SHEKOU | Normal | Normal | Normal |

Air

Central China to USA and Europe

North China to USA and Europe

South China to USA and Europe

Ocean

Ocean

Ocean

Road

European Bank Holidays

We anticipate a shortage of availability and the occurrence of delays around the bank holiday periods. Plan ahead and allow extra time for your products to be delivered.

February 16 – Lithuania

February 20 – Luxembourg*

February 21 – Portugal*, Spain*

February 28 – Spain*

March 1 – Bosnia Herzegovina*, Spain *, Switzerland*

March 3 – Belgium

March 8 – Belarus, Germany*, Moldova, Russia, Ukraine

March 11 – Lithuania

March 13 – Spain*

March 15 – Hungary

March 17 – Ireland (Eire)

March 19 – Austria*, Malta

March 20 – Spain*

March 25 – Cyprus, Greece

March 31 – Malta

*Not in all regions

The information that is available in the Weekly Market Update comes from a variety of online sources, partners and our own teams. Click below to learn more about how Zencargo can help make your supply chain your competitive advantage.

In Focus: Tensions in the Middle East continue Over the past week, tensions hav...

In Focus: A market outlook Rolf Habben Jansen, CEO of Hapag Lloyd, anticipates...

In Focus: Carriers announce GRIs in April Following the Chinese New Year holida...